2 March 2023

/ Ricardo L. Johnstone

What's the Forecast for Foreclosures in 2023? Our Prediction

Over the last three years, the housing market has gone from red hot to ice cold in the blink of an eye. At the end of 2022, foreclosure filings (i.e. default notices, scheduled auctions, and bank repossessions) were reported to be 115% higher from 2021 but down 34% from 2019, before the pandemic shook up the market.

So, what does the market have in store for this year?

In 2023, the most important factor to keep your eye on is what happens in the broader economy. Will inflation continue to soar? Will there be a recession, or will the Federal Reserve provide some additional cushion? While economic conditions continue to shift, some experts believe we’re heading toward an increase in foreclosures, especially once we hit the second half of 2023.

Are foreclosures on the rise?

There are several factors that can influence an increase in foreclosures. One of them is the percentage of household debt.

Although U.S. homeowners currently hold a high amount of equity in their properties, the equity will likely be used to pay off other forms of consumer debts, especially those that carry higher interest rates. If there is a high percentage of household debt, it’s more likely that we will see a rise in foreclosures this year.

Here are a few signals showing that household debt may continue to trend upward this year:

- Outstanding auto loans: Auto debt has increased by 6% year over year. Additionally, 60+ day delinquency on payments has crept to 1.16%. While this is still very low compared to past years, it has increased by 46% from 2021.

- Consumer credit card debt: Credit card debt increased by $46 billion in the second quarter of 2022, a 13% increase from the same quarter in 2021. This is the largest increase in cumulative credit card balances over the past 20 years.

- Household liquidity: Currently, about 24 million borrowers are in CARES forbearance, and an additional 5.1 million borrowers are in default. With the anticipated end to the CARES program on June 30, 2023, payments are expected to resume 60 days afterward. The end of the program will likely have a substantial impact on household liquidity.

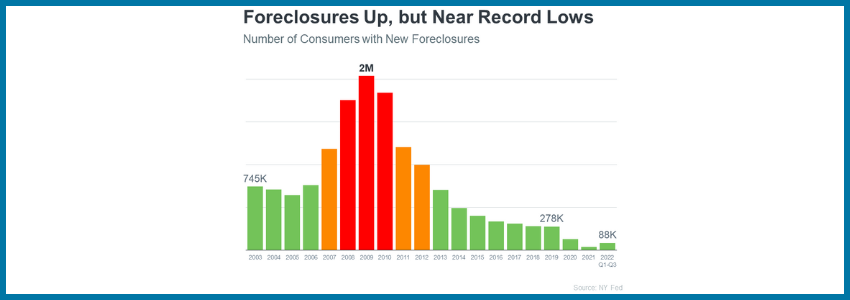

As you can see in the graph below, the years of 2008-09, when the U.S. experienced its last major recession, had the highest foreclosure rates in recent history.

If consumer household debt continues to rise, it’s safe to say that foreclosures may be on the rise, too. If you have additional questions about foreclosures or how to deal with borrower debts or defaults, you can contact attorney Ricardo Johnstone today.

This blog is not a solicitation for business and it is not intended to constitute legal advice on specific matters, create an attorney-client relationship or be legally binding in any way.