8 July 2025

/ Kathleen M. Connell

Ohio Property Value Increase: A Proactive Advisory for Ohio Creditors

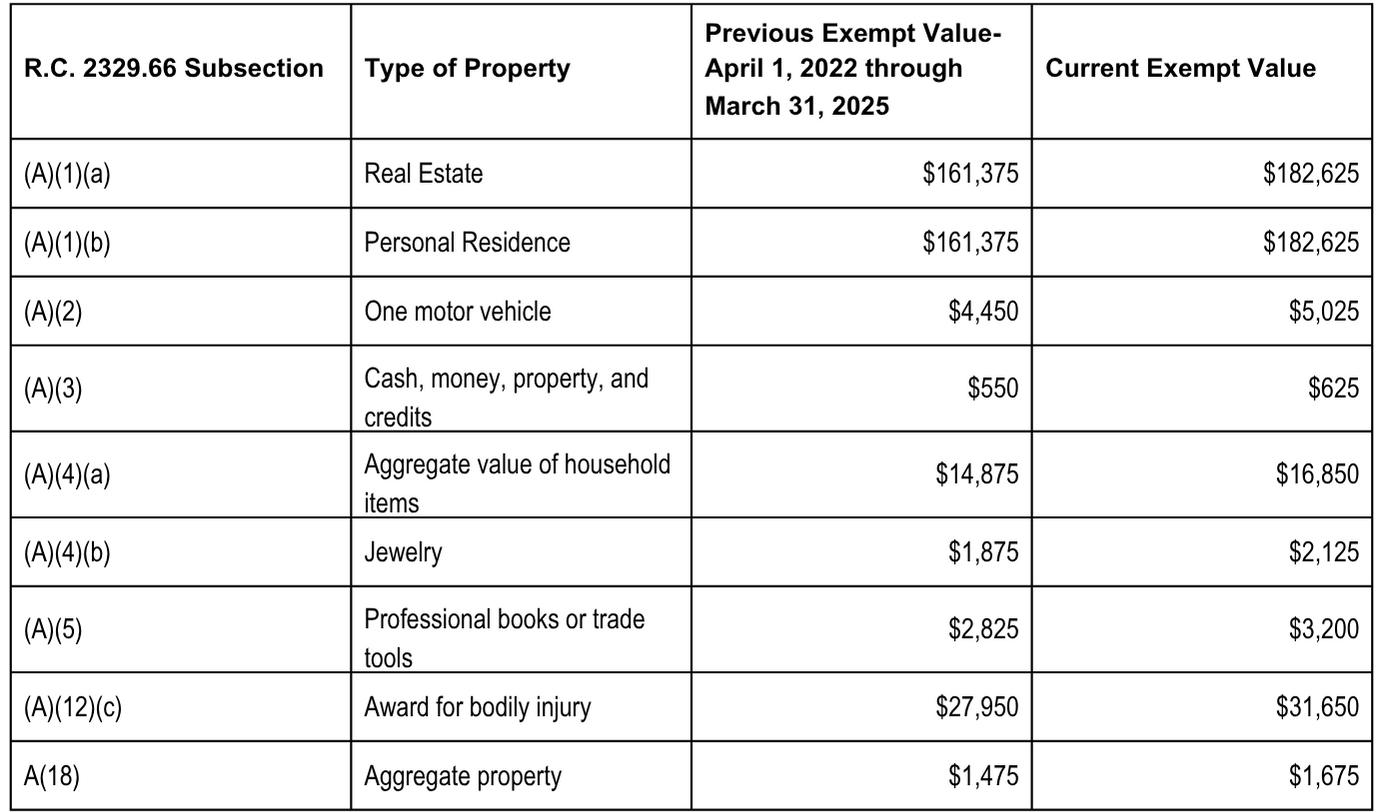

On April 1, 2025, the value of property exempt from execution, garnishment, attachment, or sale under Ohio Revised Code 2329.66 increased. This is done every three years with the intention to increase alongside the cost of living.

Most relevant to the bulk of creditors is the increase in the exempt amount for section (A)(3). The increase in this exemption reduces the amount of funds that a creditor could obtain through a successful bank attachment.

It is important to note that the exempt amount described in section (A)(3) applies to funds that are not otherwise exempt. A person may have statutorily exempt funds (such as from a pension or social security disability) in the same account as non-exempt funds (such as wages or draws from a business).

The non-exempt funds would be exempt to the extent that they are exempt under the statute. If a creditor executes on a judgment against the individual through an attachment of property under section (A)(3), then that creditor would only take any non-exempt funds in excess of $625, regardless of the amount of exempt funds in the account.

For example: If the account contains only $1,000 of non-exempt funds, the creditor would take $375. If the account contains $2,000, with $1,000 of exempt funds and $1,000 of non-exempt funds, the creditor would still take $375.

While this statute places the burden of demonstrating an exemption on the debtor, a creditor should nevertheless be aware of them in order to remain proactive. Our team is constantly monitoring this statute and its impact on debtors in Ohio. If you have any questions on this topic or would like to learn more about Weltman's consumer collections solutions, please connect with Attorney Kathleen Connell at any time.

This blog is not a solicitation for business and it is not intended to constitute legal advice on specific matters, create an attorney-client relationship or be legally binding in any way.

Most relevant to the bulk of creditors is the increase in the exempt amount for section (A)(3). The increase in this exemption reduces the amount of funds that a creditor could obtain through a successful bank attachment.

It is important to note that the exempt amount described in section (A)(3) applies to funds that are not otherwise exempt. A person may have statutorily exempt funds (such as from a pension or social security disability) in the same account as non-exempt funds (such as wages or draws from a business).

The non-exempt funds would be exempt to the extent that they are exempt under the statute. If a creditor executes on a judgment against the individual through an attachment of property under section (A)(3), then that creditor would only take any non-exempt funds in excess of $625, regardless of the amount of exempt funds in the account.

For example: If the account contains only $1,000 of non-exempt funds, the creditor would take $375. If the account contains $2,000, with $1,000 of exempt funds and $1,000 of non-exempt funds, the creditor would still take $375.

While this statute places the burden of demonstrating an exemption on the debtor, a creditor should nevertheless be aware of them in order to remain proactive. Our team is constantly monitoring this statute and its impact on debtors in Ohio. If you have any questions on this topic or would like to learn more about Weltman's consumer collections solutions, please connect with Attorney Kathleen Connell at any time.

This blog is not a solicitation for business and it is not intended to constitute legal advice on specific matters, create an attorney-client relationship or be legally binding in any way.